You’ve heard it said that ‘culture eats strategy for breakfast.’ More than once, probably. It’s become a part of corporate vernacular, a buzz phrase designed to espouse the virtues of building a strong company culture over focusing simply on business strategy.

It has long been debated whether it was actually Peter Drucker (widely cited as the source of the quote) who coined the now-famous phrase, although he’s never publicly taken credit for it. That may be, in part, because he was taken out of context. Whilst culture over strategy makes for a great addition to the management jargon we’re regularly bombarded with, it is equally meaningful when applied to culture in a more traditional sense – that is, the culture of a place and a people. The culture of the market you’re working within.

What is undoubtedly true for brands is that an understanding of the culture of the market will eat brand strategy for breakfast every time. Failing to understand the nature of culture when breaking into new markets will doom a brand or product to failure in that market. Simply cutting and pasting a product offering or marketing message from one market into another risks missing some vital differences in culture and, most importantly, fails to recognize the opportunities.

What ‘culture eats strategy for breakfast’ really means

Working with an array of multinational brands has given me a front-row seat for over two decades. I’ve witnessed tremendous successes, fantastic failures, and everything in between. One thing I have garnered from those experiences is that the brands who see cultural understanding as a foundational necessity to inform strategy find success that far outweighs that of the competitors who make assumptions about people without an appreciation for cultural nuance.

Breaking down what ‘culture eats strategy for breakfast’ really means is as simple as looking at breakfast itself. If your breakfast looks a little like most North Americans’, your table might feature pancakes, waffles, bacon, yogurt, fruit, coffee, cereal, some eggs, and toast. I’ve witnessed many an executive arrive at a Japanese breakfast buffet, dazed and confused when confronted with rice, noodles, miso soup, some cooked fish, and green tea.

Breakfasts around the world are a pure and simple representation of the inherent differences between us. But of course, culture can’t be boiled down to a bowl of rice versus a stack of pancakes. In our research, we’ve discovered that culture means different things to different people. For example, a European Cultural Values report asked respondents what came to mind when they thought about ‘culture’:

1. 39% associated culture with arts, architecture, paintings, and art galleries

2. 24% recognized culture as traditions, languages, customs, and communities

3. 20% noted literature, playwriting, and authors as their definition of culture

4. 9% of respondents cited values and beliefs (including religion and philosophy) as cultural definers.

Culture, no matter which way you slice it, is nuanced and hard to pin down.

“Culture hides more than it reveals and strangely enough what it hides, it hides most effectively from its own participants…” – Edward T. Hall (1959)

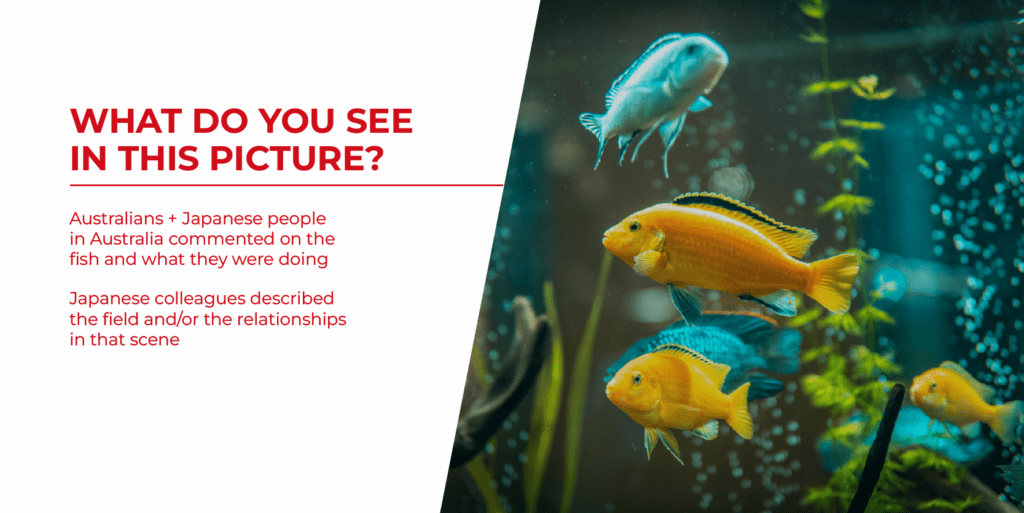

We are surrounded by culture – just as fish are surrounded by water. As researchers, our questions and answers are always influenced by culture. And so is the fish. Understanding the relationship between culture, the observer, and the observed is crucial to culturally insightful research and brand strategy.

Unmasking Japan: Question everything and take nothing for granted

Living and working in Japan since the 1990s, I am still amused by the ways in which Japan provides an ongoing challenge to Westerners’ ability to observe and analyze. In our quantitative research, for example, we can’t even be sure the scales even mean the same thing they would to us as Western born-and-bred researchers. Qualitative research provides its own set of challenges, as people don’t always mean what they say – a phenomenon that occurs whether interviewing respondents in Australia, the USA, or Japan.

Overcoming these cultural disparities requires ‘unmasking’ – giving the respondent a voice, including team members from within and without the culture, and recognizing the inherent worth and value of our differences. To do this, we:

- Observe without judgment

- Forget about what we think is important

- Refrain from persuasion

One of the most common mistakes of brands expanding into foreign markets is making assumptions about both the audience and the brand in the context of the new market. Long-held beliefs about your brand, your product, your audience’s opinions about your brand or products, and about their values, if unchecked, can lead to dangerous strategies. Although confronting these beliefs can be challenging, there is beauty and opportunity in the conflict of values, ideas, and interests that arise. Superficial readings of what respondents tell us in markets like Japan lead to conclusions like, ‘You can’t do that in Japan.’ Whereas, taking a deeper look at conflicting thoughts creates a type of transcendence that may uncover where the true opportunities lie.

Japan is one of the world’s largest and most lucrative markets – especially in the categories of personal products and luxury goods. The Japanese skincare market is expected to grow by around 6.5% (2022 – 2026) to a market volume of US$24.1b by 2026. Even with an influx of brands into the Japanese sphere over the past decade or two, the category continues to grow at pace. But it’s a complicated category, culturally. Anyone who’s browsed the aisles of a Japanese skincare store, pharmacy, or cosmetics outlet could attest.

Our client, a rapidly growing skincare brand for the USA, hoping to expand into Japan, came to us for insights. What we discovered is that Japan’s consumers have strong biases. They identify strongly as uniquely Japanese, and this plays a role in their buyer behaviors. A strongly developed and deeply held sense of ‘Japanese-ness’ plays a fundamental role in the culture and thinking of the Japanese. Thoughts such as:

- Japanese are incomparable and different from other people

- Their state of being is preferable to any other

- Non-verbal communication is important and influential

- The language is inscrutable to foreigners

- Japanese are physiologically unique compared to foreigners

These beliefs have a foundation in science, and research shows that Japanese skin is different in several ways. Our studies revealed that a one-size-fits-all approach to marketing anti-aging skincare in Japan was destined for failure. This does not mean, however, that foreign brands cannot succeed in the market. Understanding and being open to the conflicting ideals, beliefs, and values of the Japanese consumer, and understanding our own inherent biases and beliefs, opens the door to opportunity.

The opportunity lies in transcending the fact that our client is different and Japanese skin is different

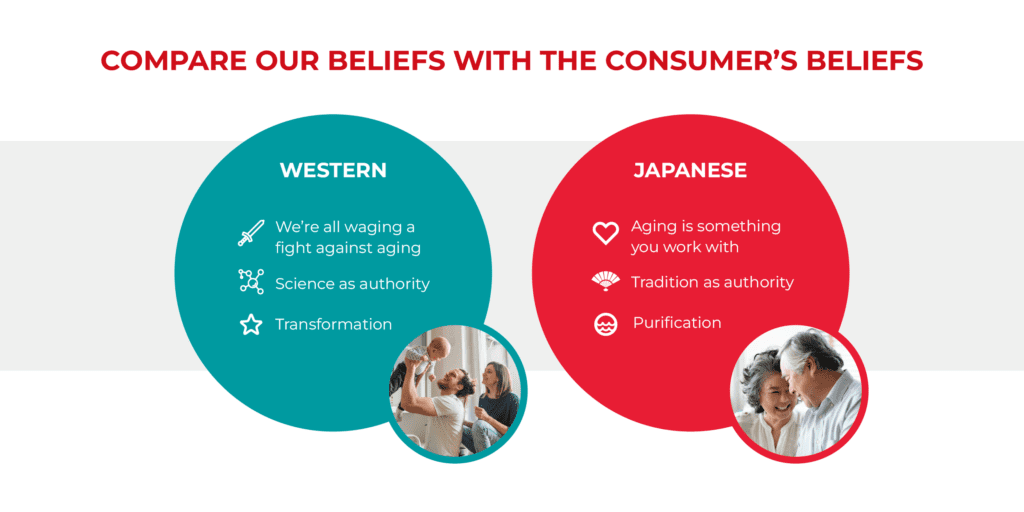

CarterJMRN’s research highlighted that, while both Western and Japanese consumers want to look better, they have very different ideas on what it takes to achieve that goal. Where the US consumer places emphasis on ‘fixing’ and ‘science’, the Japanese buyer values ‘tradition’ and ‘purifying’. The opportunities for growth lie somewhere in between – recognizing a brand’s unique expertise, ingredients, and authority and pairing those with the Japanese values of purification, tradition, and working with aging rather than against it. Japanese brand, SK-II (owned by P&G) does this brilliantly.

Based on the discovery of the anti-aging benefits of ‘pitera’ in sake yeast (how did brewery workers’ hands always look so youthful?), the skincare line aims to ‘fix’, but does so with a unique Japanese angle. Focusing on the purity of rice (from which sake is derived), SK-II marries the concepts of purification and tradition with a scientific solution. Ask yourself, what would an American SK-II look like? It’s an interesting thought experiment.

Same same but different: Our job as researchers

While it’s true that we can’t instantly provide a fix for a profound case of cultural misfit or an inability to adapt, we can map the oppositions and identify the productive paradoxes we find. Looking for innovative disruptive opportunities that appreciate we are the same, but we are different, means we can workshop a resolution and discover new opportunities in markets like Japan.

Our differences define our opportunities.